Updated Feasibility Study 2022

Hillside 2022 Optimised Feasibility and Definition Phase Engineering Study (OFS)

Overview

Rex announced on 14 December 2022 that it’s moving ahead with project financing and operational readiness plans following completion of the Optimised Feasibility and Definition Phase Engineering Study (OFS). The 100%-owned Hillside Project (Hillside) is one of the most significant copper-gold projects in the country and is located less than two hours’ drive from Adelaide, South Australia.

High level key points:

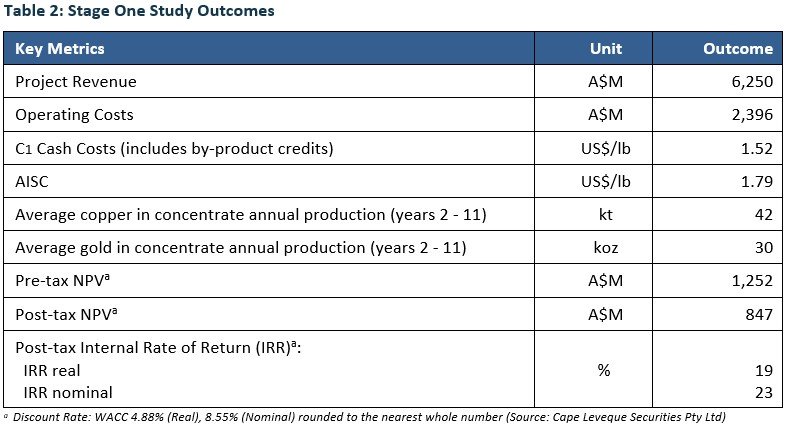

Project Value for Stage One

Net Present Value (NPV) A$1,252M (pre-tax), NPV of A$847M (post-tax)

Internal Rate of Return (IRR) of 19% (nominal IRR 23%) (spot IRR 21%)

C1 of US$1.52/lb copper (spot C1 US$1.39/lb)

4.3-year payback period

Scale and Opportunity – Stage One (11 years) lays the foundation for a 20 plus year operation and extracts around half of the current Ore Reserve. Substantial potential exists for Resource and Or Reserves growth, leading to mine life extension and higher processing rates beyond Stage One

First Production – Annual payable metal of circa 42kt copper (Cu) and 30koz gold (Au) to follow ramp-up. First concentrate delivery timing Q4CY2025, to align with the beginning of the forecast global copper market deficit

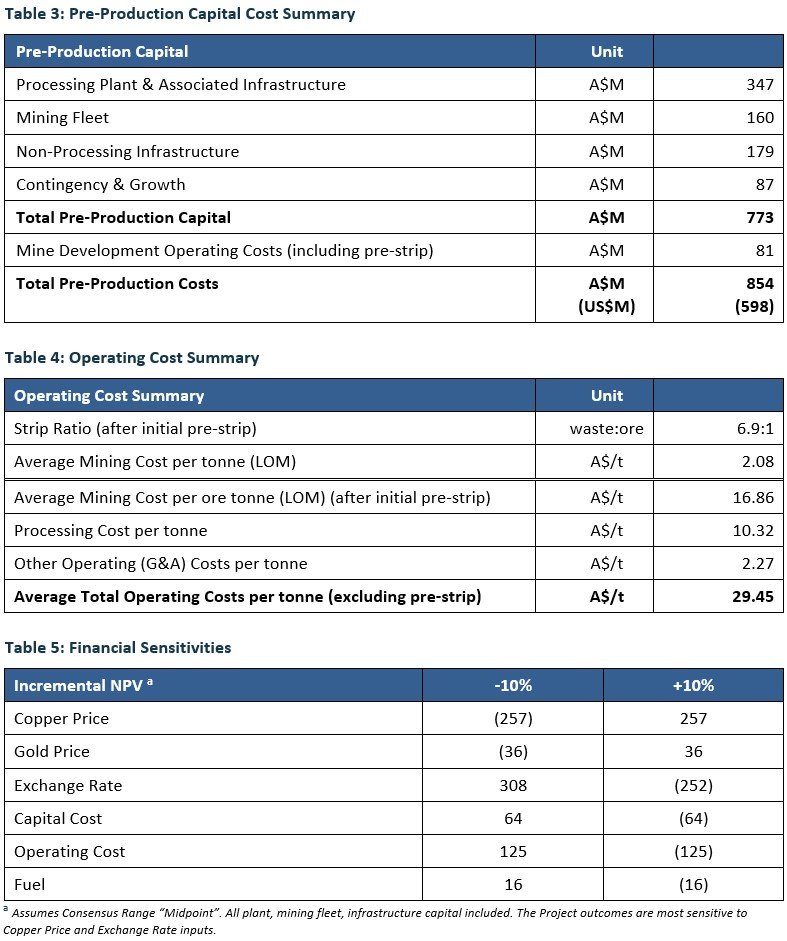

Estimated pre-production capital cost of A$854M (US$598M) all-inclusive of full fleet, pre-strip and contingency

Team – Board and Management have significant experience in delivering similar projects in Australia and internationally

Contribution – Hillside to provide employment for over 500 people during construction and over 400 during operations (over $600M in payroll) and contributing over A$200M in state royalties

Regulatory Approvals – Key approvals are in place to allow commencement of development and operations

Next Steps – Rex is actively seeking suitable funding via a structured process, to align with the detailed engineering, construction and operational readiness plans. Potential strategic partnerships via a minority interest are being discussed.

Background

The 100%-owned Rex Minerals’ Hillside Copper-Gold Project on the Yorke Peninsula in SA is one of the most significant copper-gold development projects in Australia, and one of the biggest Ore Reserves in Australia, after Olympic Dam and Carrapateena – both also located in South Australia.

Hillside is fully permitted with key approvals in place. It has State Government and regional support, and in development will become a long-term major regional employer in SA while delivering significant regional economic benefit.

South Australia is a politically stable location with well-developed infrastructure. This infrastructure includes an existing electricity grid, roads, water and a skilled labour pool. The Hillside Project will be well serviced by this current infrastructure. Further, the Hillside Project offers a high probability of future Mineral Resource growth and Mineral Resource to Ore Reserve conversion.

Based on Hillside’s 989kt Copper Ore Reserve:

Stage One mine life of 11 years

Stage One includes 151kt of copper-gold concentrate. The high-quality concentrate to contain annual payable metal after ramp-up of approximately 42kt of copper and 30koz of gold, average concentrate grade of 27%

A subsequent Stage Two based upon current Ore Reserves and Mineral Resources.

Mining operations to comprise conventional open pit extraction utilising large-scale rigid trucks loaded by excavator. A conventional flotation processing method has been chosen as the most technically and economically viable method for the separation of copper from the ore. Process tailings to be delivered to a dedicated Tailings Storage Facility. Concentrate to be trucked by road and subsequently shipped to market regularly from Port Adelaide.

Project Value – Key financial metrics: Stage One

Metal Inventory – Updated Mineral Resource and Ore Reserve

The Company has also completed in 2022 an update to both the Mineral Resource and Ore Reserve for Hillside.

The 11-year Stage One mining plan will only exploit 51% of this Ore Reserve and 26% of this Mineral Resource.

Additionally, the Company holds significant regional exploration properties surrounding the Hillside Project. In time, these licences will also be systematically evaluated as part of an overall regional copper strategy.

First Production

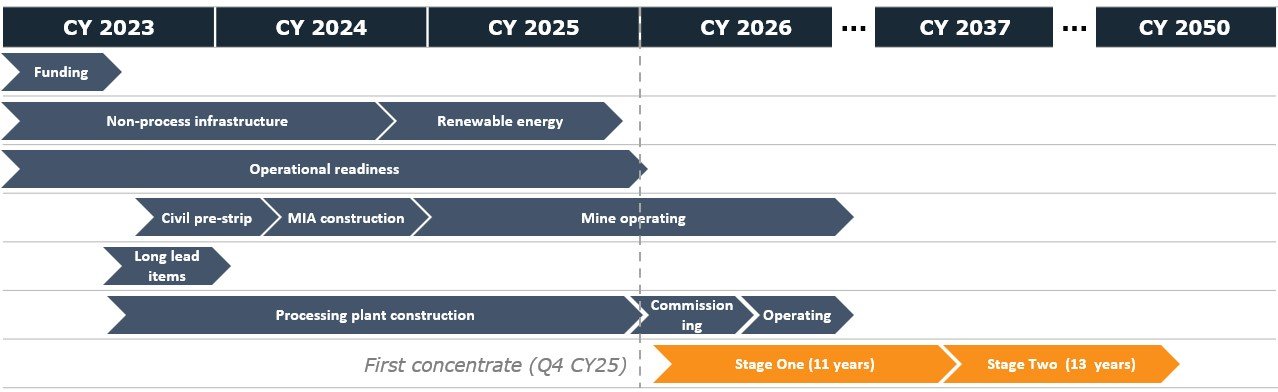

Subject to finance, delivery of first concentrate is targeted late Q4 CY2025. Following ramp-up, steady state concentrate production to contain an estimated 42kt copper and 30koz gold per annum. First concentrate delivery timing aligns with the beginning of the forecast global copper market deficit. Figure 1 below illustrates the indicative development timeline.

Figure 1: Hillside Stage Indicative project timeline

Key developments since July 2020 Feasibility Costing Update

Expansion and value improvements have been integrated into the mine design in the period following the 2020 cost update. These changes were driven by several factors, including:

An updated Mineral Resource and Ore Reserve estimate – 2022

Success of coarse particle flotation results indicating future process enhancement in the order of 30% of throughput[2]

ESG upgrades:

Design improvements at the process plant and infrastructure layout

Highway and power regulation changes and redesign

Macro capital and operating cost inflation

De-risking construction and operation phases.

The design enhancements to accommodate the factors above include:

Optimised the existing processing flowsheet design to allow for further ramp-up post-wet commissioning in line with the open pit ore supply to the ROM:

Processing plant design changes:

Replace jaw crusher with a larger capacity gyratory crusher

Upgrade coarse ore stockpile feeding a 16MW single-stage SAG mill

Design closed circuit with a pebble crusher to allow throughput increase

Additional modifications to allow for future coarse particle flotation to be implemented, likely in Stage Two

Modified mine schedule to allow 40m haul roads to improve truck mobility efficiency

Allowed for higher mine production delivery

Optimised Stage One (OFS) mine life to 11 years. Stage Two mine life is expected to double and hence extend beyond 20 years

Increased average annual copper metal production after year 1 from 35ktpa (2020) to 42ktpa (2022) after ramp-up

Realigned the development schedule in line with long-lead OEM equipment availability.

Team

The Board and Management are experienced in delivering and executing similar projects. Long-term strategic relationships with technical design and supply partners and deep knowledge of copper concentrate markets have culminated in a detailed and optimised project and operational plan that now makes up the OFS.

ESG, regulatory approvals and contribution

Greenfields operation incorporating modern ESG practices

The Company, like most, has strategic objectives and aspirations, but is focused on delivery of all site-based power requirements sourced from the generation of renewable energy during Stage One of operations. Currently, behind the meter renewable options from the domestic grid supply in SA are under investigation

Structured initiatives are factored into the Company’s Social Management and Community Engagement Plans. Work has begun to flesh these out and initiate training and development in the broader geographical region of the operation, whilst remaining totally committed to working within the local regional communities

Hillside to employ over 500 people during construction and over 400 during operations

Royalties to the State of South Australia of over A$200M and payroll exceeding A$600M.

Next steps

Immediate next steps which are to align with the Project Timeline (see Figure 1) are as follows:

Actively pursue a suitable funding package via a structured process. The timing of this will align with the Operational Readiness plan which also encompasses the broad disciplines of stakeholder engagement and engineering for Stage One operations

Potential strategic partnerships, including minority interest discussions are being prioritised. Numerous parties have expressed interest to be involved at the asset level subject to due diligence verification. The Company will investigate all potential partners and progress discussions with an objective of selling a minority interest in the Project

Continue concentrate marketing discussions

Building out the owner’s and partner teams consistent with the Operational Readiness schedule and plan

Continue with extensive on and off-site environmental monitoring for operations and continue with existing on-ground pre-development activity

Award of the initial road realignment upgrade which is planned to occur in Q1CY2023

Finalise electrical power, water and services agreements

Continue with detailed engineering

Subject to finalisation of project funding:

Award of contracts with major partners

Place key long-lead critical path orders.

The Hillside Copper-Gold Project has now concluded the necessary regulatory and community approvals plus reached a sufficient level of technical design and operational planning to formally commence the final stage of marketing and completing an appropriate funding structure. The Board and Management will be focused on these strategic discussions in the months ahead to ensure all stakeholders can benefit from a successful transition to production.