Mineral Resource

Mineral Resource

The Mineral Resource has increased at a rapid pace since Rex first acquired the Hog Ranch Property in 2019. On 23rd March 2021, Rex announced an updated Mineral Resource estimate for Hog Ranch which now contains a total of 2.26Mozs of gold.

Hog Ranch Mineral Resource growth to 2.26Mozs since acquisition in August 2019.

Table 1: Summary results for the updated Mineral Resource estimate at Hog Ranch.

Note for Tables 1 to 3: Reported tonnage and gold grades for both the Inferred and Indicated Mineral Resource estimates are rounded to two significant figures. Any discrepancy in totals is due to rounding effects. See JORC Code, 2012 Edition - Table 1 report from page 18 for details of the assumptions made for the reporting of the updated Mineral Resource estimate.

The cut-off grades reported in have taken into account the natural distribution of the gold mineralisation in addition to the relative mining and processing, and G&A costs for each deposit which would be commensurate with a gold price of approximately US$1,800 per ounce.

As part of the future economic studies for the Hog Ranch Property, options for early development of the higher-grade core to both the Bells and Krista deposits will be considered in addition to much larger, longer life and using larger economies of scale for the extensive gold mineralisation that covers the large Bells and Krista Projects. Tables 2 and 3 identify the tonnage and grade for the block models created at each deposit at various cut-off grades that will be considered for the ongoing studies at Hog Ranch.

Table 2: Summary results for the Mineral Resource estimate at various cut-off grades for the oxide mineralisation for the Krista and Bells Projects.

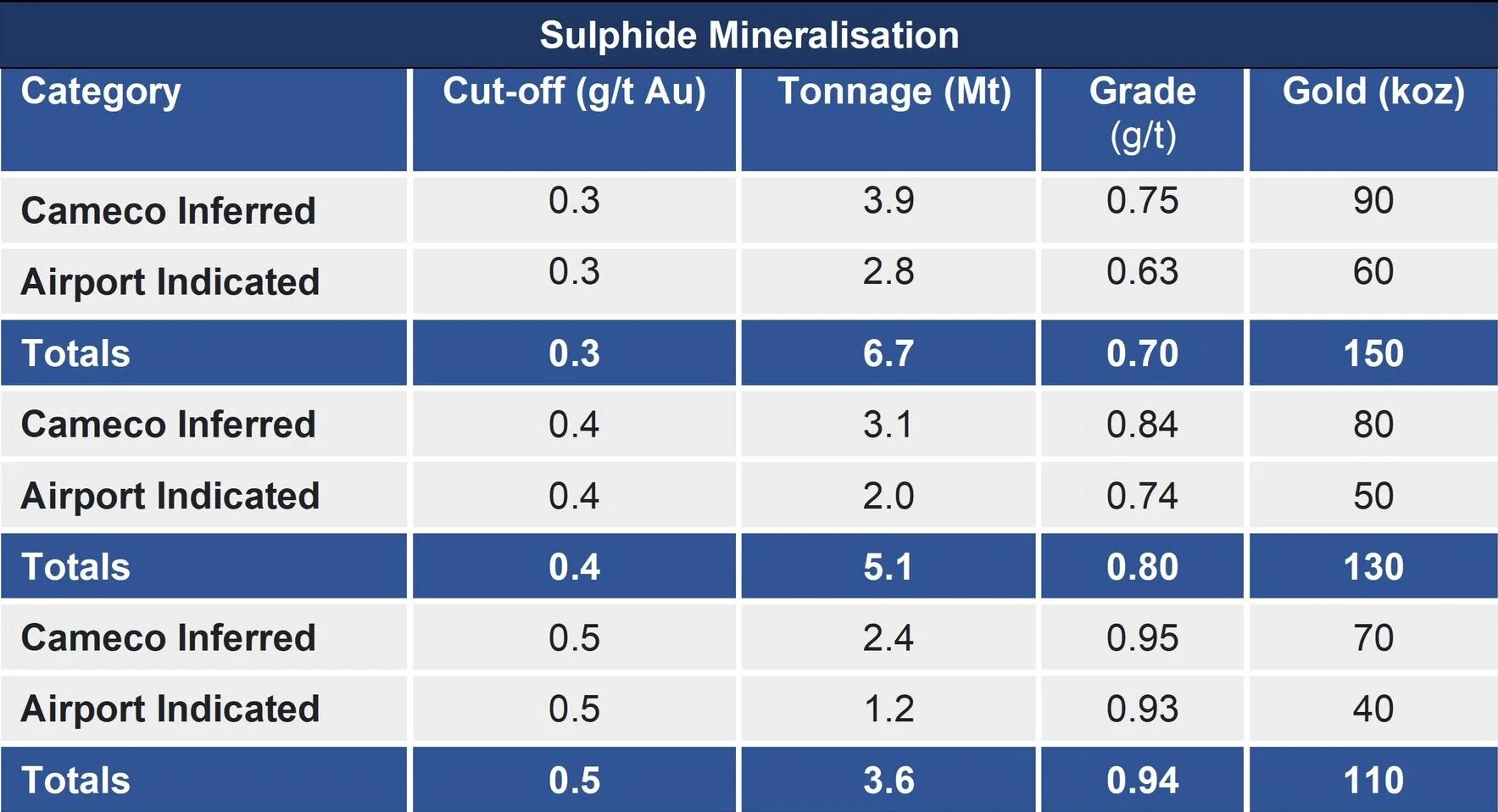

Table 3: Summary results for the Mineral Resource estimate at various cut-off grades for the sulphide mineralisation for the Cameco and Airport Prospects.

The gold mineralisation at Hog Ranch is contained within four separate deposit locations and defined as two types of gold mineralisation. The gold mineralisation at Krista and Bells is all classified as oxide type where the rocks have been weathered and the associated gold mineralisation has been demonstrated by historical mining and more recent test-work to be amenable to low-cost open pit and heap leach mining. The gold mineralisation at the Cameco and Airport deposits are classified as sulphide type, where heap leach testing information to date indicates that lower gold recoveries will occur and therefore higher cut-off grades have been used in the reporting of the Mineral Resource.

Competent Persons Statement

The information in this announcement for the Hog Ranch Property that relates to Exploration Results or Mineral Resources is based on, and fairly reflects, information compiled by Mr Steven Olsen who is a Member of the Australasian Institute of Mining and Metallurgy and an employee of Rex Minerals Ltd. Mr Olsen is also a shareholder of Rex Minerals Ltd. Mr Olsen has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Olsen consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

Forward-Looking Statements

This announcement contains “forward-looking statements”. All statements other than those of historical facts included in this announcement are forward-looking statements. Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by such forward-looking statements. Such risks include, but are not limited to, copper, gold and other metals price volatility, currency fluctuations, increased production costs and variances in ore grade or recovery rates from those assumed in mining plans, as well as political and operational risks and governmental regulation and judicial outcomes. The Company does not undertake any obligation to release publicly any revisions to any “forward-looking statement”.